Market Crash Survival Kit: 3 Tools to Grow Wealth in Chaos

Did you know that investors who bought stocks during the 2008 market crash saw average returns of over 400% in the following decade? Yet most people do exactly the opposite—they panic-sell during crashes and miss out on these massive opportunities.

Why Long-Term Thinking Wins During Market Crashes

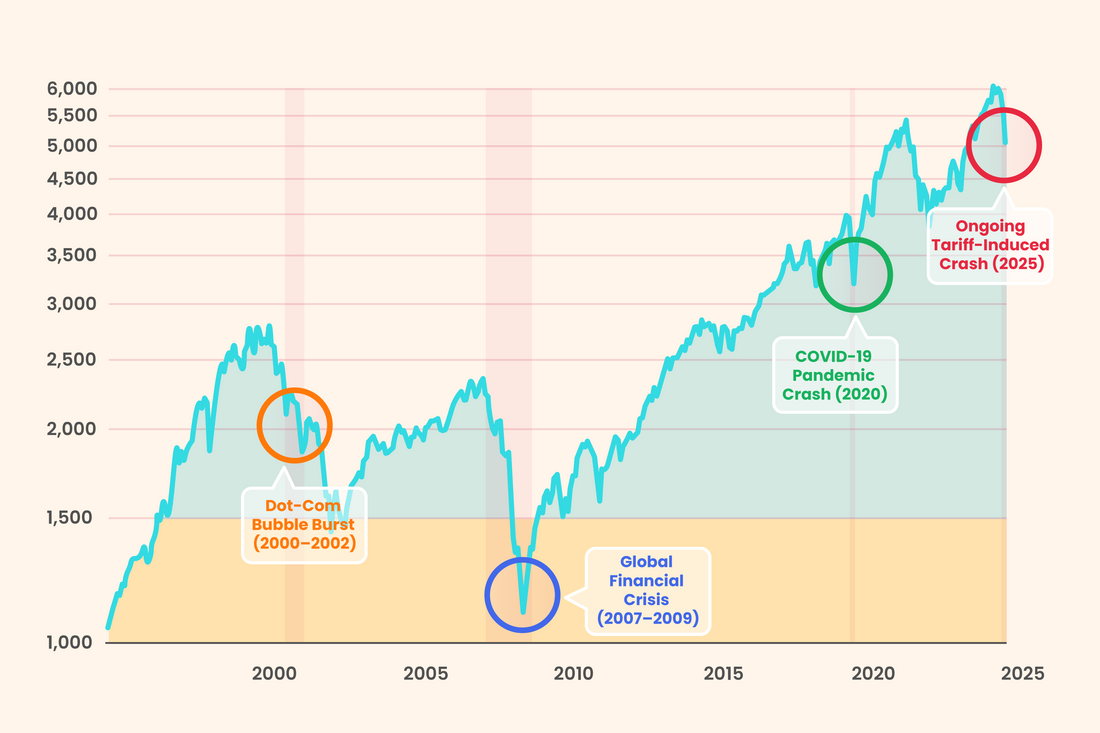

When stock prices suddenly drop by 20% or more, we call it a market crash. These crashes happen for different reasons—sometimes it's because of economic problems like high unemployment, other times it's because investors got too excited and drove prices up too high before reality caught up.

But here's what most people miss: market crashes are both normal and temporary. The stock market has recovered from every single crash in history. As Warren Buffett famously said, "Be fearful when others are greedy, and greedy when others are fearful."

Think of it like this: imagine your favorite store suddenly offers a 30% discount on everything. Would you run away scared, or would you see it as a great opportunity to buy what you wanted anyway but at better prices? The stock market works the same way.

The Psychology Challenge

Let's be honest—it's really hard to buy stocks when prices are falling. Our brains are wired to follow the crowd, and when everyone is selling, our instinct is to sell too. This is called "herd mentality," and it's one of the biggest reasons average investors lose money.

Studies show that the average investor earns much less than the market average because they buy when prices are high (when everyone is excited) and sell when prices are low (when everyone is scared). To become a successful investor, you need to train yourself to do the opposite.

Peter Lynch, who managed the incredibly successful Magellan Fund, once said, "The key to making money in stocks is not to get scared out of them." This means having the emotional strength to stick with your investments even when prices are falling.

During the 2008 financial crisis, the stock market lost about 50% of its value. People who sold their investments locked in those losses forever. But those who stayed invested and even bought more shares during the crash saw their investments more than triple in the decade that followed.

Three Strategies for Profiting During Market Volatility

Let's get practical with three specific strategies we can use during market crashes:

1. Dollar-Cost Averaging

Instead of trying to time the market perfectly, invest a fixed amount regularly, regardless of market conditions. When prices fall, our money automatically buys more shares.

For example, let's say we invest $100 every month in a stock index fund. When the market is high, our $100 might buy 2 shares. But when the market crashes and prices drop by 50%, our same $100 will buy 4 shares. Over time, this strategy can significantly boost our returns.

2. Focus on Quality Companies

During recessions, companies with lots of debt often struggle or go bankrupt. But companies with strong finances (a strong balance sheet—which means they have more assets than debts) tend to survive and even gain market share from weaker competitors.

We can look for companies with:

- Low debt levels

- Consistent cash flow

- Products or services people need even during bad times

- Competitive advantages (things that make them special and hard to copy, like a well-known brand or unique technology)

3. Consider Defensive Sectors

Some industries perform better during economic downturns. These include:

- Consumer staples (food, household products)

- Healthcare (people need medicine regardless of the economy)

- Utilities (everyone needs electricity and water)

- Discount retailers (people look for bargains during tough times)

Adding some investments in these areas can help protect your portfolio during market troubles.

The Hugo Alpha Market Crash Game Plan

Having a plan before a market crash is crucial. Here's a simple three-step approach:

- Decide in advance what we’ll do when the market drops 10%, 20%, or 30%. Will I add more money to my investments? Which investments will I buy more of?

- Limit how often we check our investment account during market downturns. Checking daily can lead to emotional decisions. Once a month is enough.

- Remember our time horizon. If I’m investing for goals that are 10+ years away, short-term market movements shouldn't change my strategy.

It’s not about predicting the future; it’s about being ready for it when it arrives. As others panic during the next recession or market plunge, Hugo Alpha investors will be prepared—not just to weather the storm but to thrive in its aftermath.